ESocial X EFD-REINF X DCTFWEB integration

ESocial now has extended deadlines

3 de September de 2018Relevant currency fluctuations allows contributors to review the taxes on currency oscillation

25 de September de 2018Do you know how it all affects your day to day business?

Brazil is going through an important moment of technological and structural reformulation of mechanisms of accounting control, fiscal, tax and personal department routines.

This process impacts companies of all sizes and extends to individuals – employer and taxpayers.

Specifically in the case of legal entities, we know that the volume and complexity of operations are bigger. Therefore, it is always necessary to evaluate the progress of its operational activities.

Since they are the basis for information and data cross-referencing for the main existing ancillary statements, these activities may impact the progress of accounting and tax deeds and the recording of information by the personal department.

So how do you ensure the monitoring this information not letting any details go by?

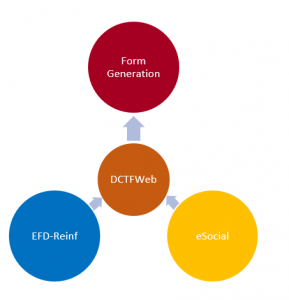

With the creation of ESocial, EFD-REINF and DCTFWEB, there will be a direct connection between the sending of information – accounting, tax and labor – and the database at the Internal Revenue Service for the main controls of debits and tax credits.

That is to say, for example, that the issuing of a simple collection form – which has long been generated by manual filling – will now be done on the basis of integrated information.

Here’s how the integration will work:

Note that guides to collect, rectify or supplement any information will only be generated when the declaration of origin of the obligation is rectified.

This way, all information must be regular before issuing.

See how these statements will briefly impact your life:

ESocial – System that integrates information related to fiscal, labor and social security obligations.

The E-Social seeks to reduce the time consumed by companies in the execution of different tax, social security and labor obligations, through the use of a consolidated information base.

The information generated by the E-social system will be connected to the DCTF-Web database. The latter will be responsible for maintaining a database that will serve to cross-breach obligations, make payments and monitor company regularity.

EFD-REINF – Digital Tax Bookkeeping of Retentions and Other Tax Information.

The EFD-REINF will contain IRRF, CSLL, PIS, COFINS and Social Security Contributions information on services taken and rendered.

In the beginning, social security information will be sent (Registers R-2010, R-2020, R-2030, R-2050 and R-2060) and, according to the progress of its implementation, other tax information will be added.

In order to fully comply with this declaration, the entire process of sorting invoices for services taken and rendered, as well as the accounting and tax deeds and the calculation of taxes, must be correct and in accordance with what will be informed.

DCTF-WEB – Declaration of Debts and Federal Tax Credits Social Security and Other Entities and Funds

The DCTF-WEB is an ancillary tax obligation, whereby the taxpayer confesses debts of social security contributions and contributions to third parties.

This system will be used to edit the declaration information, transmit it and generate the collection document (DARF).

This new statement will replace the current DCTF and will anticipate the submission of the information.

While the current format considers the 15th business day of the second month following the triggering event, DCTFWEB is due on the 15th of the subsequent month.

Therefore, the information will need to be sent with an advance of approximately 30 days, which will impact all financial and administrative management.

For this reason, more than ever, financial information must be integrated into accounting, tax, labor and social security deeds, and all need to be ready and reviewed by this date.

Conclusion

It is crucial that companies are increasingly prepared for all these changes.

Consequently, it is very important that processes are reviewed and supported by integrated management systems that are effective and ensure accuracy in the generation and transmission of information.

Investing in technical knowledge and technology has been a practice among companies seeking greater efficiency in their operations in order to mitigate risk and reduce operating costs.

RTURBA is always attentive to the most innovative tools. That’s why we work with an integrated management system, with a 100% secure web platform, accessible and prepared to serve companies from different segments.

Learn more at http://www.rturba.com.br/en