DCTFWEB – What are the advantages and disadvantages of the integrated debit and credit reporting system?

BLOCO K: What are the deadlines to compliance?

23 de August de 2018

ESocial now has extended deadlines

3 de September de 2018DCTFWEB – What are the advantages and disadvantages of the integrated debit and credit reporting system?

Created by Normative Instruction No. 1,787 dated February 7, 2018, the DCTFWEB (Declaration of Federal Tax and Social Security Tax Credits and Other Entities and Funds) is a module of the Public Digital Bookkeeping System (SPED, in Portuguese acronym) for registration, through which taxpayers confess debts of social security contributions and contributions to third parties and generates Federal Tax Collection Documents (DARF, in Portuguese acronym).

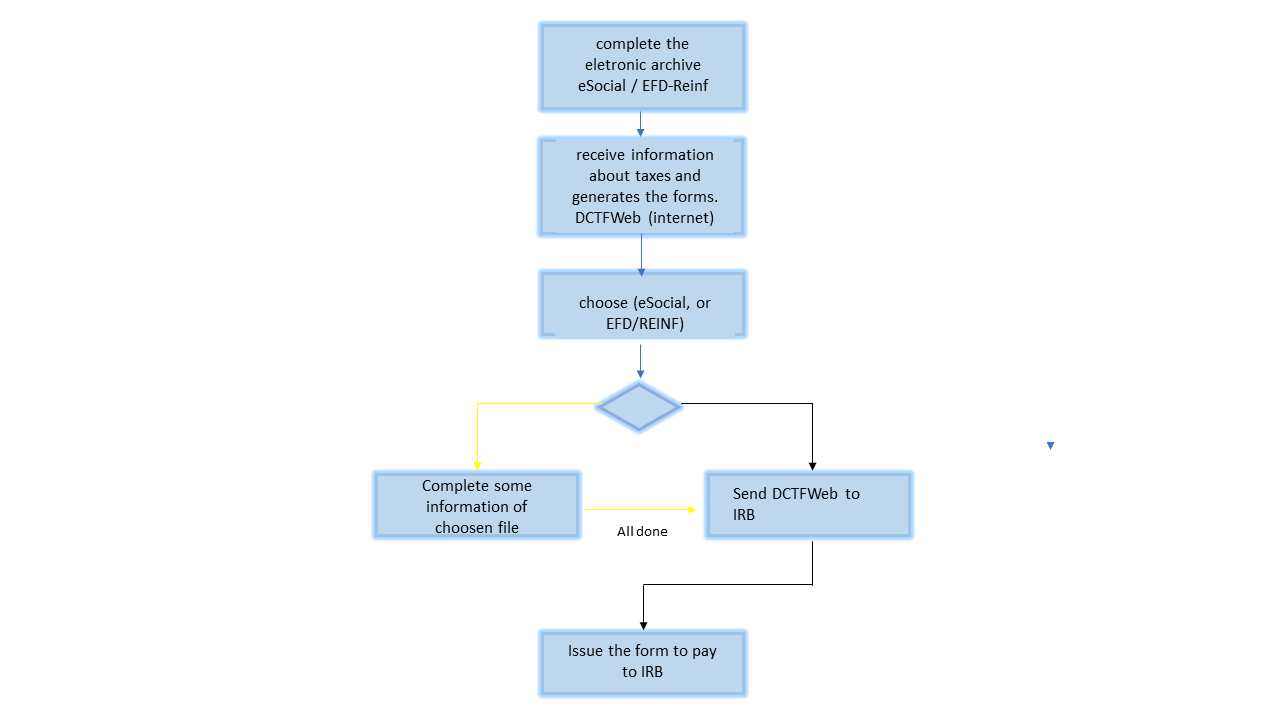

The main characteristic of this new computerized system for confession of debt is the fact that there is a direct connection with other ancillary declarations. This connection will allow state agencies to have a greater capacity to track the reported information. DCTFWEB will have a direct link with ESocial and EFD-REINF through the transmission of two accessory obligations, which once transmitted will feed the DCTFWEB database.

Another important detail is related to the making of DARF, which became totally linked to the information contained in ESocial, EFD-REINF and DCTFWEB. In the current format, the taxpayer has the possibility of manually informing the amount that he deems correct for the issue of the Collection Document. This manual procedure has for a long time been subject to mistakes and mistaken fills. In this new format, DCTFWEB ensures that information is increasingly accurate and more readily available for analysis.

As provided in art. 2 of IN 1787/2018, DCTFWeb is a very comprehensive ancillary statement, so it will reach not only legal entities in general, but also individuals, individual micro entrepreneurs, federal and regional councils and public agencies that are in the condition of taxpayers or tax officials.

In its initial phase, DCTFWeb should be transmitted to companies with billing in the calendar year of 2016 above R $ 78 million, from the generating facts that occur from 08/01/2018.

The remaining taxpayers will be handed over to DCTFWeb as of 01/01/2019, with the exception of public administration agencies, which will send it on 07/01/2019.

It is worth noting that at this stage only social security and labor information will be transmitted. The other information to be transmitted will be subject to the disclosure of a schedule by the IRS.

Fine for Infringements or Omissions

The taxpayer who presents DCTFWeb with inaccuracies or omissions is subject to a fine of R $ 20.00 (twenty Brazilian reais) for each group of ten incorrect or omitted information, subject to the minimum fine.

Omit information to suppress or reduce contribution (?)

The non-transmission of DCTFWeb subjects the company not only to the receipt of MAED, but also to be prevented from obtaining the Negative Debit Certificate (CND).

Minimal fine

The minimum fine to be applied in the event of delay in delivery of the declaration shall be R$200.00 (two hundred Brazilian reais), in the case of omission of a declaration without occurrence of generating facts, and R$ 500.00 (five hundred Brazilian reais) in all other cases.

The minimum fine will have a reduction of 90% (ninety percent) for the MEI and 50% (fifty percent) for the ME and the EPP included in the National Simples.

At this moment of profound regulatory changes of accounting and tax control, it is essential to have professionals in the market who can contribute to the compliance of companies to this new reality.

We have the methodology and experience to advise companies to achieve better results.